BLOGS

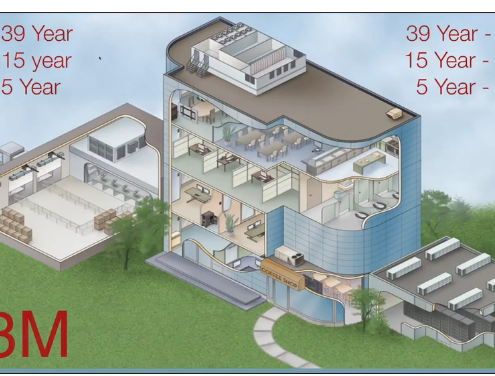

How Cost Segregation Study Can Tap Into Thousands Of Dollars For Commercial Property Owners & Leasees?

Often when I am first introduced to a business owner who owns a commercial building and I offer doing a complimentary assessment to discover if he or she qualifies for a Cost Segregation Study and what other Tax Credits they may qualify for and are not taking advantage of,

Why so many commercial building owners don’t know the benefits of Cost Segregation on their bottom line?

Often when I am first introduced to a business owner who owns a commercial building and I offer doing a complimentary assessment to discover if he or she qualifies for a Cost Segregation Study and what other Tax Credits they may qualify for and are not taking advantage of,

How You Can Be Leaving Tax Money On The Table When You Hire.

What is most surprising is that many business owners, large and small, are totally unaware that they are leaving thousands if not millions of dollars on the tax table by not knowing of the 1996 federal tax credit program, called the Work Opportunity Tax Credit [WOTC].