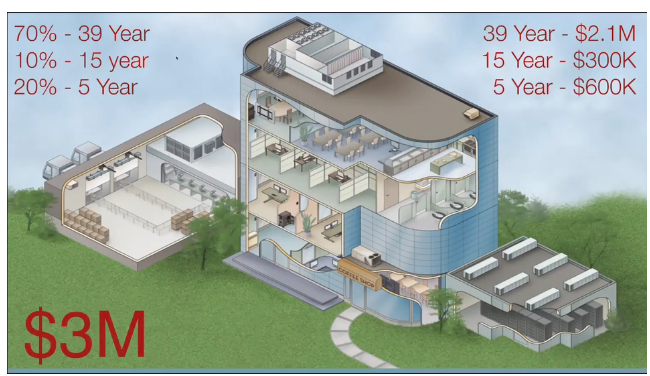

If you had just bought a commercial building worth about $1,000,000, for example, and I gave you an option of collecting $120,000 today or waiting 39 years, the typical depreciable period, which one would you most likely choose? More than likely most would choose to get the money now so you could use it to reinvest into your business, increase pay to your employees, increase your retirement stash, or maybe take that vacation that you’ve always wanted to take. This is what our Engineered-based Cost Segregation Studies offers our clients.

Trump’s TCJA Brought Gift To Commercial Property Owners

President Trump’s Tax Cuts and Jobs Act that took effect in 2017 put a lot of money in the pockets of small and large business owners. But, it also eliminated a lot of tax deductions that business owners had became used to. This has left business owners and their tax professionals scrambling for tax savings and relief. Having a Cost Segregation Study done can not only increase your cash flow, but reduce your depreciable tax period dramatically. We can also go back several years and collect savings that you missed. Our Engineered Cost Segregation Study takes advantage of the new tax law that permanently increased limits under Section 179 expensing that allows for immediate deductions for the entire cost of qualifying equipment or other fixed assets up to specified thresholds. These qualifying assets can include most everything that you’ll find in and outside of building such as, light fixtures, wiring, plumbing, flooring, wall partitions, wall coverings, parking lots & more.

If you have either purchased or renovated a commercial building, that includes real estate buildings, over the past 20 years worth more than $500,000, even if you are leasing, there’s thousands of dollars that you are sitting on by having your real property reclassified to personal property. And rather than paying depreciating taxes for 39 years you could pay for just 7 years and cash in today on the savings.

Some of the best industries who we have successfully worked with their tax professionals saving on average $250,000 are manufacturing, medical offices, funeral homes, retail property developers, convenience/grocery stores, auto dealerships, restaurant, hotels, & office complexes.